Solutions

Double click here to edit new New Header component

-

Solutions

-

SOLUTIONS

Barclays Investment Bank offers advisory, finance and risk management services that connect your ideas to capital and power possibilities.

-

-

Insights

-

INSIGHTS

View thought-leading perspectives from Barclays Investment Bank’s financial experts and Research analysts.

-

-

News and Events

-

News and EventsNEWS AND EVENTS

Get the latest news about Barclays Investment Bank businesses, people and our work in the community, as well as our upcoming events and conferences.

-

- Contact Us

-

Client Login

- Barclays Live

- BARX

Client Login

Parsys 1

Parsys 2

As part of the UK Government’s commitment to tackling environmental challenges and building a more sustainable economy, it has issued its inaugural green gilt. The bond’s record-breaking* order book signals how investors view green finance as a vital driver of social change and economic development.

Launched in the run up to the United Nations Climate Change Conference (COP26), the bond is a key element of the UK’s Green Financing Framework, which is designed to help the country meet its 2050 net zero targets while funding infrastructure investment and creating the next generation of green jobs.

*Source: Dealogic, September 2021

Our green gilt issuance is supporting the UK’s ambitious environmental and climate goals, and we have been genuinely impressed by the very strong level of investor support as well as the encouragement we have received while bringing this landmark sterling green transaction to the market.Sir Robert Stheeman, Debt Management Office CEO

The initial bond raised £10bn from investors, and was the biggest inaugural green issuance by any sovereign and the largest ever order book for a sovereign green transaction. It was also particularly notable for the diverse range of investors it attracted, including new entrants to the gilt market.

The Government Debt Management Office approached their inaugural gilt in a uniquely transparent way, explicitly targeting both environmental impact and specific social co-benefits on which they are committed to reporting. So we were particularly pleased at the strong interest from both domestic investors, who are increasingly integrating environmental, social and governance factors into their investment decisions, and to ESG conscious overseas investors entering the gilt market for the first time.Lee Cumbes, Head of DCM & Public Sector EMEA, Barclays Corporate and Investment Bank

The money raised by the green bond will be used to finance a range of projects such as zero-emission buses, offshore wind power, and schemes to decarbonise homes and commercial buildings across the country. In addition to job creation, the social co-benefits of the green expenditures financed include access to affordable infrastructure and socio-economic advancement.

Meeting low-carbon goals

Barclays is proud to have worked as joint bookrunner on this transaction to support the UK Government’s initiative using innovative financing solutions to target the transition to net zero.

Green and sustainable finance will play a key role in facilitating the global climate transition for all. I’m exceptionally proud that Barclays supported the UK Debt Management Office in this transaction. As one of the largest global capital markets businesses, we are in a unique position to help accelerate this transformation.Jes Staley, Barclays Group CEO

Parsys 3

Parsys 4

Related content

Case study

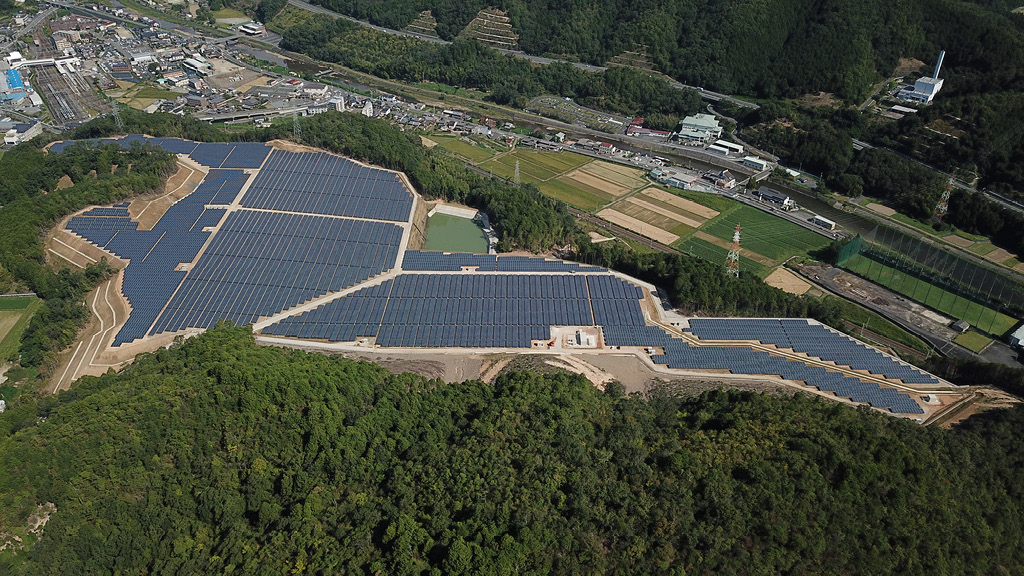

Growing green bonds with Renewable Japan

Barclays and Renewable Japan, a leading renewable energy service provider, teamed up to issue more than ¥80 billion (£520 million) in renewable energy bonds in just over 3.5 years.

Case study

thredUP’s IPO shows sustainability is in fashion

In its recent IPO, thredUP modeled its commitment to changing the fashion industry’s wasteful ways.

Our solutions

Investment Banking

Powering the growth of companies, governments and institutions with global advisory, financing and risk management services across sectors.

Parsys 5

Parsys 6

Parsys 7

Parsys 8

Parsys 9

Parsys 10

Parsys 11

Parsys 12

Parsys 13

Parsys 14

Parsys 15

Parsys 16

Parsys 17

Parsys 18

Parsys 19

Parsys 20

iParsys for Double Pixel component