Solutions

Double click here to edit new New Header component

-

Solutions

-

SOLUTIONS

Barclays Investment Bank offers advisory, finance and risk management services that connect your ideas to capital and power possibilities.

-

-

Insights

-

INSIGHTS

View thought-leading perspectives from Barclays Investment Bank’s financial experts and Research analysts.

-

-

News and Events

-

News and EventsNEWS AND EVENTS

Get the latest news about Barclays Investment Bank businesses, people and our work in the community, as well as our upcoming events and conferences.

-

- Contact Us

-

Client Login

- Barclays Live

- BARX

Client Login

Parsys 1

Double click here to edit Hero Media component

RESEARCH | 3 POINT PERSPECTIVE | SOLVING SUSTAINABLE

How the global steel industry can go green

Contributors: Maggie O'Neal, Tom Zhang

25 Apr 2022

Contributors: Maggie O'Neal, Tom Zhang

25 Apr 2022

Barclays Corporate and Investment Bank clients can access the full report, entitled Green Steel: From rhetoric to reality. Sign in

Parsys 2

Double click here to edit Go To Section component

Go to Section

Parsys 3

1. The steel industry is heavily polluting

The World Steel Association estimates that the industry accounts for 7-9% of total global carbon emissions – second only to power generation as a source of CO2.1 Most of that CO2 comes from coal-powered production methods.

Manufacturers recognise that they need to produce more cleanly. Their customers, too, are applying pressure, as they try to hit their own targets linked to indirect emissions. Steel accounts for about one-third of supply-chain emissions for cars and buildings, and around half for white goods and renewable energy equipment.

But decarbonising the sector is far from easy, given the lack of commercially viable alternatives to coal. Just two of the 17 companies in our Research analysts’ coverage have emissions below the 2050 steel industry target, per tonne of steel produced. Both of them are based in the US, which accounted for less than 5% of the world’s crude steel production last year.

2. Greater use of the Electric Arc Furnace method would help

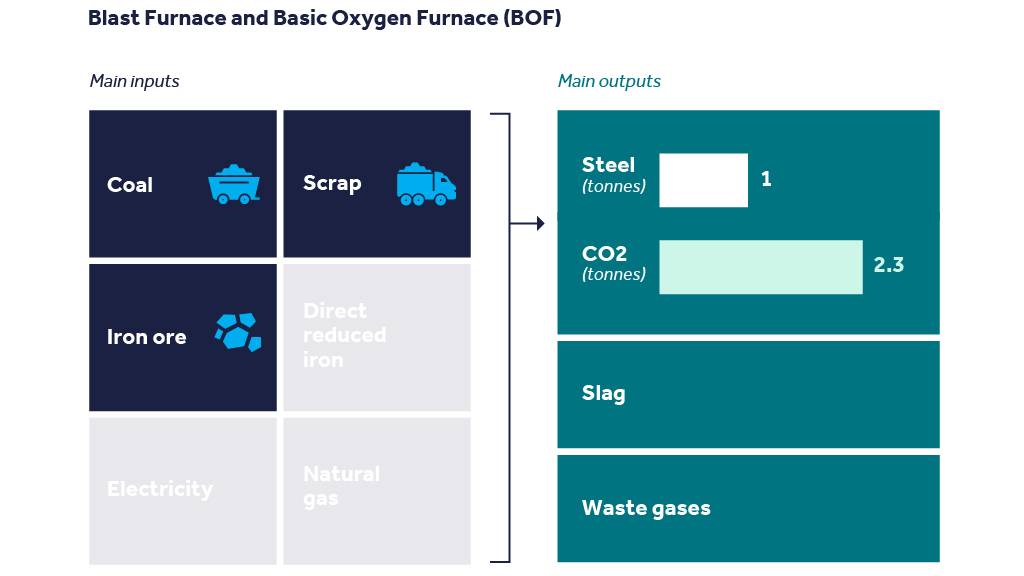

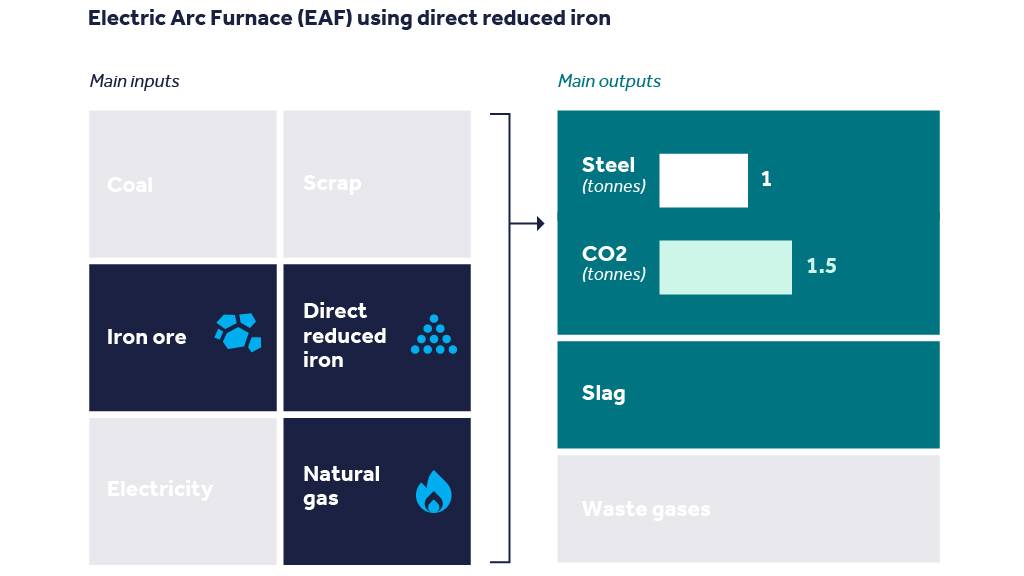

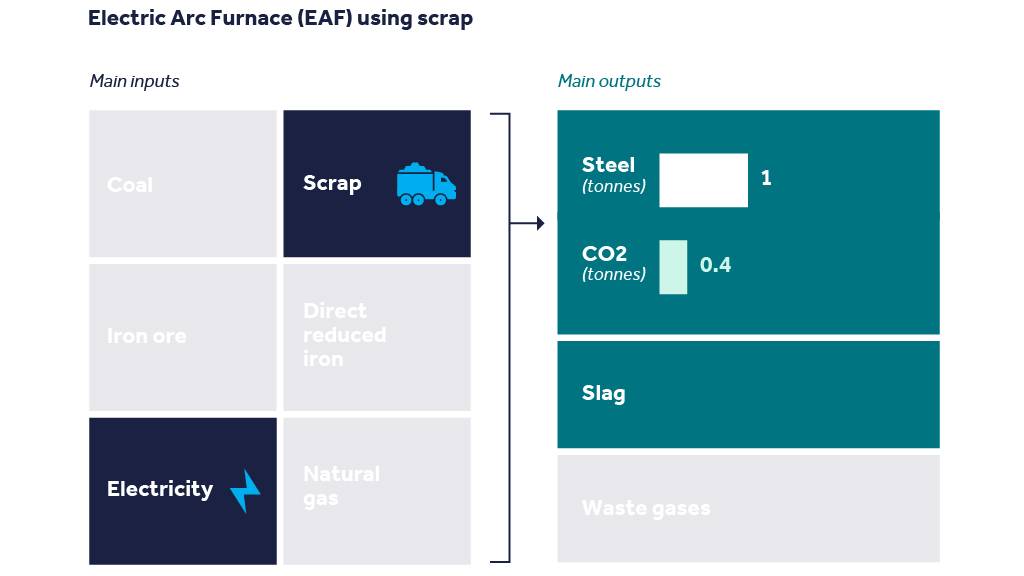

The vast majority of the world’s steel is produced either via the Blast Furnace/Basic Oxygen Furnace (BOF) method or the Electric Arc Furnace (EAF) method. The former involves using coal to reduce iron ore and create new “primary” steel. The latter uses electricity to melt old scrap steel and produce recycled, “secondary” steel.

Use of the BOF process is widespread, accounting for about 70% of global production. Yet it is much less clean. Producing one tonne of steel in this way generates 2.3 tonnes of CO2 – almost six times as much as from an EAF using scrap.

The dominant BOF production method has a large carbon footprint, but there are cleaner alternatives

Source: Company reports, Barclays Research

Scrap supplies are limited, however, and EAFs cannot always produce the quality required for certain applications.

That puts a premium on the development of alternatives, such as EAFs using Direct Reduced Iron (DRI): a scrap substitute, produced using iron ore pellets and natural gas. An EAF using DRI emits around 1.5 tonnes of CO2, making it dirtier than EAF using scrap but significantly cleaner than the BOF process.

Production could get cleaner still if hydrogen were to replace natural gas within the DRI process. That way, low-emission primary steel – “green steel” – would be possible to manufacture.

3. Government support is key to making green steel a reality

At the moment, the costs to produce green steel are formidable. Our Research analysts estimate that a DRI/EAF process using hydrogen would add about $100 to operating costs per tonne of steel produced. That would drive most producers out of business.

If, however, the cost of hydrogen were to tumble – to below $1/kg in Europe and 70 cents/kg in the US – then the technique could be viable. That makes it imperative for producers to invest in the development of hydrogen-related infrastructure.

Indicative operating cost breakdown for steel production technologies ($/t)

Source: Barclays Research

Note: Key long-term assumptions are LT green hydrogen at $4/kg and carbon credits at $80/t.

Government grants and subsidies will be needed to encourage investment, especially in China, which produced more than half of the world’s steel in 2021. In more mature markets, returns to shareholders are likely to fall, as producers fund projects from their cash flows.

But there is a real urgency to act, given the industry’s long lead times for development. Blast furnaces tend to have an average life of around 40 years, but need significant upgrades after 25.

Decisions need to be taken now if companies want to meet their 2050 emissions targets.

1. Climate change and the production of iron and steel, World Steel Association, 2021.

Parsys 4

Double click here to edit Banner component

Parsys 5

Double click here to edit Experts Panel Card component

About the analysts

Maggie O’Neal

Credit Research

Tom Zhang

Equity Research

iParsys for Double Pixel component